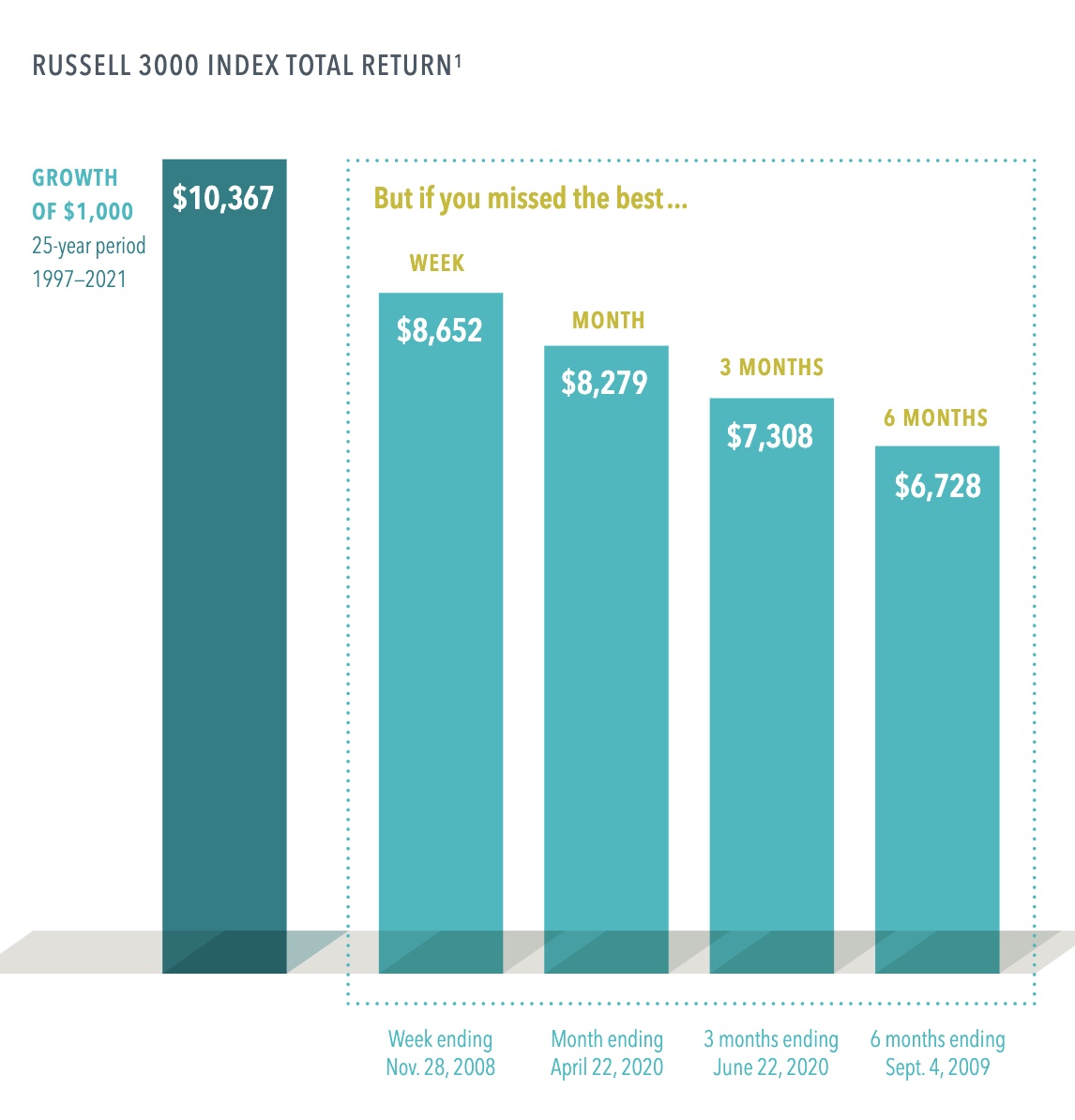

The impact of being out of the market for a short time can be profound, as shown by this hypothetical investment in the stocks that make up the Russell 3000 Index, a broad US stock market benchmark. Staying invested and focused on the long term helps to ensure that you’re in position to capture what the market has to offer.

- A hypothetical $1,000 investment made in 1997 turns into $10,367 for the 25-year period ending December 31, 2021.

- Over that 25-year period, miss the Russell 3000’s best week, which ended November 28, 2008, and the value shrinks to $8,652. Miss the best three months, which ended June 22, 2020, and the total return falls to $7,308.

- There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst—so the evidence suggests staying put through good times and bad